Photo: Africa Studio (Shutterstock)It’s totally fine to prefer “buy now, pay later” payments over credit cards or to simply avoid the debt trap of plastic altogether. The only problem is that without credit cards, it’s harder to build up your credit score, which means you’ll have a tougher time qualifying for a loan. Fortunately, there are ways to build up your credit without relying on a credit card.

Federal student loans Most federally backed student loans don’t require a credit history, so it’s a great way to start building credit—assuming that you already intended to go to school, of course. Payments made against these lines of credit are reported to the three main credit bureaus (Equifax, TransUnion, Experian) and become part of your credit report. Consistent, on-time payments will improve your credit score.

Get a credit builder loan

Credit unions and smaller banks offer a type of loan designed for people with low—or nonexistent—credit scores so they can build up their credit (you might also see them referred to as “fresh start loans”). It’s a lot like a loan in reverse—the lender will deposit a loan amount, like $1,000, into a closed account, which you won’t be able to access until you’ve paid it all off in monthly installments that include some interest (5% on the low end) for a term typically ranging from six months to two years. The reason that you’d go to a bank for this is that they’ll report your on-time monthly payments to the credit bureaus, which can boost your credit score.

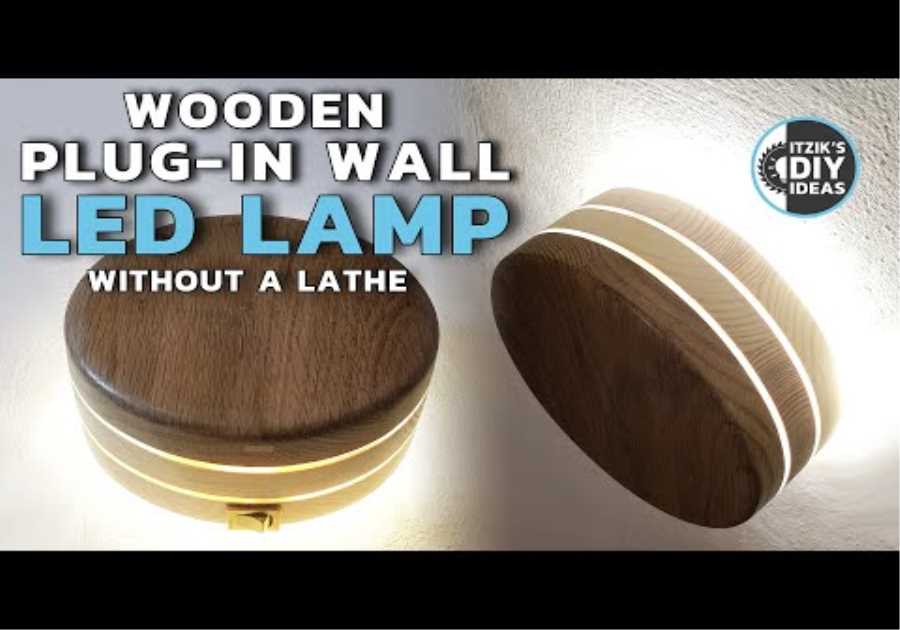

G/O Media may get a commission

Become an authorized user Becoming an authorized user on another borrower’s credit card is an easy option if you’re new to credit, as it allows you to piggy-back on someone else’s credit history. The best part is that you don’t even have to touch the credit card to benefit from the other person’s on-time payments and low payment balance. This requires a lot of trust, however, as one authorized user can affect the other’s credit score by spending carelessly or missing payments (ideally, an authorized user is someone you’re close to and trust, like a family member).

Personal loansPersonal loans are installment loans, which means that you get a lump sum right away but you’ll have to pay fixed monthly payments and interest rates. Some lenders will offer personal loans if you have no or bad credit—lump sums that range from $1,000 to $50,000, to be paid back in a span of 12-60 months. However, you might need a co-signer to qualify for lower rates. You could be better off going with a credit builder loan if you’re only interested in building up your credit score. Whatever you do, be wary of predatory payday loans that often have interest rates above 36%.

Paying rentMost landlords won’t automatically report your rent payments to credit bureaus, which is a shame since it’s likely the biggest, most consistent expense in your budget. However, there are rent-reporting services that can process your rent payments so that they’re factored into your credit reports, although the service comes with a fee of roughly $100 a year. The tricky part is that it will require cooperation from your landlord or building manager, which is no small feat. Nerdwallet has a good overview of your options here.

Apply for a secured credit card

Okay, so these are technically credit cards, but they’re also very restrictive, with low credit limits. As with credit builder loans, this type of card requires an up-front deposit that usually matches your credit limit—say, $500. After you use the card for a certain period of time, you’ll get your deposit back and can upgrade to a regular, unsecured credit card (if you want). These cards can be convenient, too, as they can be used for transactions that are simply easier with a credit card, like paying for a phone bill online. In the meantime, making on-time payments will help you build up a credit history.